Gas Holidy a Headache-Inducing Déjà vu

May 1, 2008

Two summers ago, I made a step toward the dark side by trading in my bicycle for a shiny new SUV. I couldn’t have timed the switch more poorly. This was the first summer of record setting gas prices, when the pump price first climbed over $3.00 a gallon. Fair weather activists went to work that summer, sending out chain letters over email and myspace demanding a boycott of gasoline. Let’s boycott all gas stations for a day! Or better yet, let’s just boycott Exxon! That’ll show ’em!

After reading these, I (and anyone who had taken Econ 101) immediately were hit with terrible headaches. Why? These consumer gas schemes pandered more toward emotions than to any rational economics theory.

Now two years later, a similar situation is occurring. However, this headache isn’t being spread by zealous internet users. This fire is being fanned by two of our own presidential candidates. Their idea is not a boycott, but rather a “gas holiday” where the federal gas tax is erased for the summer driving months.

But wouldn’t lowering the gas price increase demand? And when demand increases, won’t the prices go back up? The short answer is Yes. Peter Schwartz of Global Business Network describes this as the true American energy policy: “Maximize demand, minimize supply and buy the rest from the people who hate us the most.”

Under such a scheme, consumers would see little change in gas prices this summer. Without taxes of course, our own Federal government’s revenue would shrink. And the real winners in the game would be….you guessed it….the big oil companies.

According to this article by Thomas Friedman of the NYT, “This is not an energy policy. This is money laundering: we borrow money from China and ship it to Saudi Arabia and take a little cut for ourselves as it goes through our gas tanks. What a way to build our country.”

Paul Krugman, another NYT columnist points out in a post that any attempt to quell gas prices for the summer driving season is too little, too late. The petro we’ll use this summer has already been extracted and refined. No matter what politicians will promise for the summer, there’s simply not much to be done.

My car gets 14 mpg on a good day and public transit isn’t an option for my commute. I’m sitting front and center in the cross hairs of high gas prices, and I would be ecstatic if there were a plan that could help me out. Unfortunately, there doesn’t seem to be much of a rationale consensus from our leaders. Of the three candidates, only Obama has voiced his disapproval of a gas holiday. Both McCain and Clinton have publicly favored this gas-tax holiday.

It’s time for our politicians to take a proactive and logical approach to our energy policy. All the research, rationale, and logic point to the same conclusion. It’s been close to 30 years since President Jimmy Carter proclaimed we would stop being dependent on foreign oil and that we would develop oil alternatives. Perhaps its time we began working toward this long-time goal.

Many Politicians Missing the Youth Vote Opportunity

April 25, 2008

Dear Pennsylvania Governor Rendell,

I’m a 20-something year old who loves politics. Even more than usual, I can’t seem to escape the excitement of the current campaign season. It’s been a long, long time since so many people have become civically engaged with our political system. This is a time we should celebrate; which is why I was so surprised to hear some comments from you which belittled young voters. In a recent forum, you seemed to infer that young voters weren’t informed about the upcoming presidential candidates. That we “drink the Kool-Aid of [Obama’s] wonderful speeches” resonates the sentiment that 18-29 year olds are being suckered in by a slick campaign message and a charismatic orator. With this in mind, I have to share a story with you.

I spent four years at a state university, during which I was accosted daily by students, flyers, posters, and emails telling me to “be informed and get involved”. I sat in classes where students absorbed books and articles written by the world’s top experts. I watched as kids debated the intricacies of tax policy in lecture halls that sat 300 people- where so many young voters attended that it was “standing room only”. I’ve witnessed 20 year olds show up late for work or class because learning and being informed was more precious than a few hours of sleep. To be truthful, this describes me and most of my peers.

Governor Rendell, your opinion of my demographic is grossly incorrect. We may be young; but we are not ill-informed nor are we uneducated. In fact, I would argue that the majority of young voters have a much stronger grasp of campaign issues than most demographics. Take a glance at any college or university in the country, and chances are you’ll find less apathy than in any other demographic. Look at any of the political campaigns today, and you’ll see young volunteers pounding the pavement and knocking on doors, ready to speak to anyone and everyone about the issues. Find a political website, and you’re bound to see young voters go toe-to-toe in educated political debate with much older people. To be blunt, you have misjudged many of us.

We aren’t professional politicians, so it should come as no surprise that some young people can’t rattle off which legislation a candidate has sponsored. But don’t be fooled – when we come home from a campaign event, chances are you’ll find us scanning the paper and the internet for information on the candidate. We do the homework because we know what’s at stake. We’re the ones fighting in Iraq and Afghanistan. We’re the one’s who can’t find jobs because of our current economic state. We’re the ones fighting to afford health care, and we’re the ones who will be dealing with climate change long after you’re gone.

Of course, I would never expect anyone to accept my thoughts without first doing their own homework. Student organizations, universities, and communities are always looking for speakers to participate in meetings and town halls. Please consider an appearance at any of these so you can see for yourself just how engaged students can be. Attending just one student debate may completely change your opinion of this promising demographic.

Today, young people are standing up and participating in our democratic political process. Help celebrate this by engaging our young demographic!

See the video that started it all here

What’s to Gain with Privatization?

April 16, 2008

Today, you can own almost anything. Anything. You can own it. If you or I were to talk with our great-great grandparents, they wouldn’t believe just how much someone in today’s world can own.

I’m not speaking so much about material goods; so much as I’m speaking to the wide breadth of ownership we experience every day. It’s not just land and goods anymore. You can own ideas, pictures, slogans, and even living organisms.

This ability to own things is known as privatization. Privatization is the tool which makes capitalism work. It brought us out of the dark ages, and produced our world today. But is making things “ownable” always good for society?

Many people think so. Members of the Fraser Institute, are some of them. In the documentary “The Corporation”, the president of the free-market powerhouse tells us that if we could find a way to privatize our air, we wouldn’t have any more pollution. Just like when someone owns a house or a car, the air would become the owner’s responsibility. They would care for it, and see that it isn’t polluted. Seems like a good idea, right?

There’s another part of privatization that needs to be talked about. Owning a house for instance means I can put up a fence. I can keep people out. If I wanted to, I could even keep you out!

Over the weekend, I caught a story about a company who put up a big fence. The story is about a village in India. The village’s water wells have been privatized, and are now owned by Coca Cola. Coca Cola uses the wells to supply water for its Dasani bottled water product, which is enjoyed by thirsty people all over the world. That is, it’s enjoyed by thirsty people who can afford to buy it.

It seems that no matter how thirsty the local villagers become, Coca Cola’s financial fence keeps them out. Can’t afford this water? Too bad! Villagers have taken up strong protests against the bottling company. Rioters broke down a police blockade and protested the factory in the hope of soon quenching their thirst.

A similar story took place in Bolivia back in 2001. Like many countries during that time, Bolivia was struggling to develop its economy. Just like anyone who’s starting to develop a business, Bolivia needed a loan. And so just like a businessman, Bolivia went to the bank….the World Bank. The World Bank agreed to loan Bolivia money, but there were a few conditions. These conditions were called “Structural Adjustment Policies”. The World Bank wanted to make sure it would get repaid, so it required Bolivia to privatize many of its state-run services. All of a sudden, everything in Bolivia was for sale! Roads, hospitals, energy…… and water.

A similar story took place in Bolivia back in 2001. Like many countries during that time, Bolivia was struggling to develop its economy. Just like anyone who’s starting to develop a business, Bolivia needed a loan. And so just like a businessman, Bolivia went to the bank….the World Bank. The World Bank agreed to loan Bolivia money, but there were a few conditions. These conditions were called “Structural Adjustment Policies”. The World Bank wanted to make sure it would get repaid, so it required Bolivia to privatize many of its state-run services. All of a sudden, everything in Bolivia was for sale! Roads, hospitals, energy…… and water.

Bechtel, a US company, was awarded the contract to manage the water in Cochabamba, Bolivia’s third largest city. As part of the contract, Bechtel was promised a certain return on its investment. That money had to come from somewhere, and so Bechtel raised the rates. Copies of water bills show that household water bills increased by 60%! Almost instantly, water began to cost a lot than most could afford. The strain was too much, the people rioted, and one boy was killed and hundreds others wounded.

Stories like these lead me to believe that privatization may not be the golden answer to all our problems. There are some basic necessities to human life that we simply cannot fence. What if being poor meant you couldn’t breathe because you couldn’t afford air? What if it meant you couldn’t drink because water was too expensive? And when it comes to health care, food, basic shelter…well the answer is hard to say. Privatization may have brought us out of the dark ages, but can it also put us back in?

Where do we draw the line?

I just caught an article from the Seattle Times titled “City of Seattle Won’t Buy Bottled Water“. The article states that Mayor Nickels approved the order because of the positive environmental impact, as well as the financial savings the city will experience. By cutting out bottled water expenses at various city events, Seattle could save close to $60k a year.

Besides costing more than tap water, bottled water has an array of negative environmental effects. Bottling water uses oil, energy, and natural resources. America’s water bottling industry burned 1.5 million barrels of oil last year. In addition, most empty bottles find their way into landfills.

“This is a matter of leading by example,” Nickels said. “The people of Seattle own one of the best water supplies in the country, every bit as good as bottled water and available at a fraction of the price. When you add up the tremendous environmental costs of disposable plastic bottles clogging our landfills, the better choice is crystal clear.”

I recently stumbled upon a website gathering pledges from people to stop using bottled water. I can’t find the blog that first posted the pledge (sorry unknown blogger), but if your a progressive individual who wants to fall in love with his or her tap water, sign up for the pledge! There’s also a quick collection of facts, some of which I poached for this posting. Check it out!

The public’s somewhat negative perception of bottled water is nothing new. Over the past year or so, it was revealed that several bottled water companies use tap water in their products. Many restaurants made headlines several months ago by taking bottled water off their menus in favor of tap water.

In my opinion, Mayor Nickels is doing one helluva job maintaining our lead as an environmentally progressive city. Better watch out San Francisco. You may be one step ahead of us for now, but give it time…

If you’re like me, it takes a good cup of coffee to get your morning started off right. And if you’re even more like me, you might think about the impact your coffee habit may have. By now, a lot of us coffee drinkers have heard about things like Fair Trade, organic, and shade grown coffee. Good news! Corporate and local coffee houses are offering these environmentally sound choices to us more frequently. Chances are, if coffee that’s environmentally friendly is offered, you’ll take it.

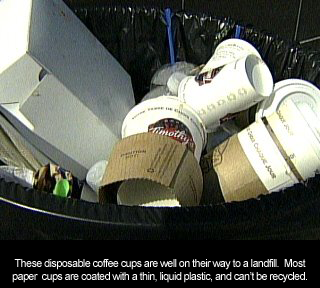

There’s another part of your coffee addiction that has a global impact. Your coffee cup. We see them everywhere but almost never give ’em a second thought. But those lattes and americanos that keep us working hard have a bitter environmental impact. In 2006, Americans added an estimated 16 billion coffee cups to our landfills! Think about it – how many cups have you thrown away this month? This week? The waste starts to add up fast, and in more places than just landfills. The entire process is incredibly resource intensive.

Here’s where it gets worse. Disposable paper cups are made almost exclusively from fresh wood from our forests. Once the lumber is transformed into paper, it’s coated with thin plastic and pressed into a cup. That plastic helps protect your hands from hot coffee – but it also condemns your cup to a landfill. Recycling can’t be done effectively on either end of a cup’s life cycle.

The real tragedy is that alternatives are easy and accessible. All of us have a reusable coffee mug stashed away in our kitchen, it’s just a matter of remembering to grab it on the way to work or school.

Now I’ll be honest. I’m one of those “latte-drinking, Prius-driving, Birkenstock-wearing” types of people. But using your own reusable coffee cup has more than just an environmental appeal. Those smart enough to remember a cup are often treated to a discount at coffee houses. Considering that most reusable coffee cups have life expectancies of 5 to 10 years, those discounts can add up. As an additional bonus, bringing your own cup helps out your favorite coffee house. Disposable cups are one of the largest costs to local shops, and most places would love to cut down on their expensive overhead.

Using your cup has more personal benefits as well. Reusable cups tend to keep your hot coffee hot and your cold drinks cold. If you’ve ever experienced a winter in Seattle, you know a mocha can go from hot to luke-warm in just a few minutes. Wouldn’t it be nice to enjoy your drink leisurely instead of chugging it down or throwing away the last few sips?

Using your cup has more personal benefits as well. Reusable cups tend to keep your hot coffee hot and your cold drinks cold. If you’ve ever experienced a winter in Seattle, you know a mocha can go from hot to luke-warm in just a few minutes. Wouldn’t it be nice to enjoy your drink leisurely instead of chugging it down or throwing away the last few sips?

The next time you’re getting ready to leave the house, think about drinking responsibly and bringing a reusable coffee cup. It’s quick and convenient, easy and painless. Not only will you be saving yourself money, you’ll be doing something good for the planet too.

For more in-depth information regarding sustainable coffee cups and disposable cups, please visit www.SustainabilityIsSexy.com

Carbon Tax and Fuel Efficiency a Powerful Combo

March 4, 2008

Last week, I unwittingly got into a discussion with the folks from carbontax.org about BC’s new carbon tax. Most of the comments showed strong support for a carbon tax, but I was surprised that there was little support for encouraging fuel efficiencies. The collective mind seemed to think that a carbon tax was the only tool needed to curb carbon emissions. Now I doubt that specific mindset is a good representation of what most people believe, but it got me thinking. I agree a carbon tax is a great strategy, but is it the only one? Where does a carbon-tax fall short? Does encouraging fuel efficiency pick up the loose ends?

Pitfalls of a Carbon Tax

- A carbon tax’s goal is to lower the miles people drive. But what about those who can’t reduce? Commercial truck drivers are one group of carbon-emitters that won’t be changing their habits because of a carbon tax. For transport companies, driving less means less business. Transport services may become a bit more expensive, and truck drivers may not see a pay raise for a while, but carbon emissions won’t drop substantially.

- For any substantial change to happen, consumers need to notice consequences. However, most carbon taxes are modeled the same: taxes start off very small, and are slowly increased over time. By slowly, I mean about 10 cents a gallon slowly. Politicians are wary of pegging the tax too high, but adding an extra 10 cents a gallon tax is almost unnoticeable at today’s volatile gas pumps. For many, paying a bit extra at the pump is more convenient than changing their habits to be more environmentally friendly. It’ll take years before the tax is expensive enough to force a change in the average consumer. Even then, there will always be people rich enough and willing to pay to pollute. A carbon tax is a great long-term strategy, but doesn’t offer any short-term solutions.

A carbon tax is one sided, as there are two basic ways to change someone’s habits. One way is through negative consequences, the other through positive incentives. Training animals (stern voice vs tasty treat) is one basic example. When it comes to carbon emissions, a carbon tax is a negative consequence. But negative consequences aren’t always enough to cause change. Take a look at marijuana use. Marijuana has been illegal in the US for decades…but the drug’s use hasn’t slowed. A balance of negative consequences and positive incentives is the most effective means of changing habits.

A carbon tax is one sided, as there are two basic ways to change someone’s habits. One way is through negative consequences, the other through positive incentives. Training animals (stern voice vs tasty treat) is one basic example. When it comes to carbon emissions, a carbon tax is a negative consequence. But negative consequences aren’t always enough to cause change. Take a look at marijuana use. Marijuana has been illegal in the US for decades…but the drug’s use hasn’t slowed. A balance of negative consequences and positive incentives is the most effective means of changing habits.

The Benefits of Fuel Efficiency

If a carbon tax is peanut butter, fuel efficiency is the jelly. The two strategies combined provide a balanced plan toward decreasing carbon emissions from fossil fuels.

- Promoting fuel efficiency is the perfect short-term plan because it’s available now! The technology needed to reduce carbon outputs is already sitting on car lots. Burning carbon fuels more efficiently has the same effect as driving less. Right now, the big obstacle is getting fuel efficient vehicles into the hands of drivers. Once that problem is tackled, fuel efficiency could reduce carbon emissions in a very little amount of time.

Dollar for dollar, fuel efficiency has a bigger effect on consumers. BC’s carbon tax will cost a family about $50 a year. Driving a fuel efficient car could save that in a month or less. My personal situation: If I were to drive the hybrid version of my current auto, I’d save $50 in two weeks. That’s $2600 annually! When it comes to carbon, promoting fuel efficiency is more powerful simply because of the dollar amount attached. Additionally, fuel efficiency provides a positive incentive for emitters to change their habits. Wouldn’t you drive a hybrid if it meant saving hundreds every year?

Dollar for dollar, fuel efficiency has a bigger effect on consumers. BC’s carbon tax will cost a family about $50 a year. Driving a fuel efficient car could save that in a month or less. My personal situation: If I were to drive the hybrid version of my current auto, I’d save $50 in two weeks. That’s $2600 annually! When it comes to carbon, promoting fuel efficiency is more powerful simply because of the dollar amount attached. Additionally, fuel efficiency provides a positive incentive for emitters to change their habits. Wouldn’t you drive a hybrid if it meant saving hundreds every year?

- Fuel efficiency can reach people that a carbon tax can’t. Truck drivers and commuters who can’t bike or bus can still lower their carbon emissions with better fuel efficient cars. The same can be said for people who travel in distances more than what is covered by a carbon-tax. Fuel efficiency works no matter where the fuel is bought and burned.

The bottom line is that both a carbon-tax and fuel efficiency incentives are working toward the same goal. The planet doesn’t care how carbon emissions are lowered, so long as it’s done quickly. Why limit our options? The best strategy is one that uses everything in our toolbox; be it a carbon-tax or promoting fuel efficiency.

BC’s Carbon Tax Takes the Gold

February 25, 2008

It looks like British Columbia is a few steps ahead of Washington State’s push toward a carbon tax. BC’s Finance Minister, Carole Taylor, introduced an escalating carbon-tax just a few days ago. Starting on July 1st, the tax will add an extra 2.4 cents for every purchased liter of gasoline (that’s about 9 cents a gallon). The tax rate will escalate annual until 2012, when the tax will stop at 7.2 cents / liter (about 28 cents a gallon).

Compared to the carbon-tax proposed in Washington State, the rates are relatively the same. So what makes this tax so much better?

First off, BC’s carbon tax bill isn’t all bite, and isn’t completely insensitive toward consumers. “We want to bring in the benefits first,” said Taylor. “We made a policy decision that it was an important part of this carbon tax that individuals were protected as we start out on this journey.” The benefits will be coming by way of a one time $100 check in the mail. The cash will (hopefully) help individuals adjust to a lower carbon producing lifestyle.

Secondly, the tax has managed to by step an important criticism. A gas tax is often seen as regressive, by placing an ever-growing burden on the lower and middle class. The BC carbon-tax is different. The money made from the tax will be funneled right back to consumers by means of lower income taxes. Some qualifying families will also receive $100 annual offsets throughout the program. This system makes the tax “revenue-neutral”, so even the government isn’t profiting.

Despite all this, BC’s carbon-tax bill misses an important objective. It’s great to see that the government wants “to bring in the benefits first”. But a one time check isn’t the type of benefits that will advance an environmentally-friendly lifestyle. Wouldn’t it be better to send out “convert your car to bio-fuel” coupons instead of $100? Or use the money to build decent commuter bike lanes?

Even more importantly, the bill doesn’t really stimulate a change in behaviors. At the end of the year, the costs for BC consumers balance out. Without added costs and without any extra incentive to change, why would anyone change their habits at all?

Regardless of its downfalls, this bill is a huge political success. Historically, many politicians are hesitant to support a carbon-tax for fear it may be career damaging. BC’s new tax is proof otherwise. United States – it’s time to catch up!

An In-Depth Look at Obama and Clinton’s Senate Records

February 21, 2008

Political experience is a hot topic for presidential candidates Clinton and Obama. I was planning on writing an article detailing each’s experience in the Senate, but Grassroots Mom beat me to it. Her analysis shows a great in-depth look at the various bills each candidate has authored or sponsored during their Senate tenure. Read it and you will become informed.

The Highlights:

-

Voting records show that both candidates support similar issues. Obama is frequently a co-sponsor on Clinton’s bills, and vice versa.

-

Although each candidate shares similarities, they’re method to create change is different. In the instance of lead paint for example, Clinton suppored legislation that would provide tax incentives to companies who removed lead paint. Obama supported classifying lead paint as “hazardous” and regulating its use. Market incentives vs Regulation.

-

Clinton has introduced a hefty amount of healthcare legislation. Her focus is mainly on women and children.

-

Obama’s legislation is more broad. Healthcare, energy, global warming, nuclear proliferation, foreign policy (ie Iran), and Blackwater are all subjects of bills he brought forth.

-

An interesting point: many of Clinton’s bills have no co-sponsors. Speculation as to why this is can lead to any number of conclusions.

In 2005, the Congressional Budget Office estimated the cost of the Iraq war at $500bn. Stiglitz and the book’s co-author, Linda Bilmes, found this number to be surprisingly low. Discrepancies began to unveil themselves. For instance, the listed cost of the 2007 troop surge only accounted for combat troops. No funds were budgeted for the additional support troops needed as well. After years of data mining and number crunching, they’ve found the cost to be between 2 and 3 trillion dollars.

In 2005, the Congressional Budget Office estimated the cost of the Iraq war at $500bn. Stiglitz and the book’s co-author, Linda Bilmes, found this number to be surprisingly low. Discrepancies began to unveil themselves. For instance, the listed cost of the 2007 troop surge only accounted for combat troops. No funds were budgeted for the additional support troops needed as well. After years of data mining and number crunching, they’ve found the cost to be between 2 and 3 trillion dollars.