Overfished West Coast Salmon May Have Shallow Future

March 25, 2008

An important piece of Northwest culture may have a bleak looking future. Both the New York Times and NPR reported today on the potential collapse of the salmon fishing industry along the west coast. Phil Anderson with the Washington Department of Fish and Wildlife told NPR the current level of salmon is the worst he’s seen in 35 years. Scientists are blaming lower salmon counts on dead zones throughout the ocean which have been deprived of nutrients. Unfortunately, this isn’t the first time history has seen an ocean species struggle…..

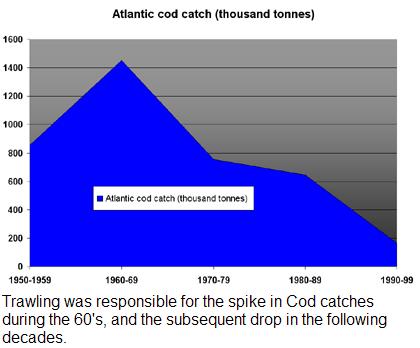

Before supermarket salmon fillets and sushi crazes, most of the world’s seafood came from the Atlantic cod. And it was everywhere. The fish in “fish ‘n chips”. Salted snacks on long sea voyages. Cod was responsible for the frozen fish stick craze of the 50’s and 60’s. The fish was even the inspiration for nations to expand their borders into the ocean to protect fishing rights.

Cod has been the central part of a lot of cultures – but don’t bother trying to find it in your supermarket today. Atlantic cod was fished nearly to extinction years ago, and it has yet to make any comeback. Current counts show the Atlantic cod population is 1% of what it was in 1977.

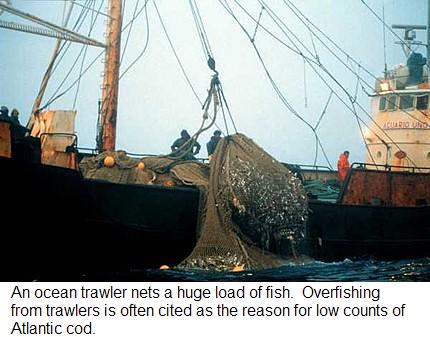

Blaming fingers point the cod’s near-extinction in many different directions, but there’s one that most seem to agree upon. The modern fishing trawler.

For a moment, imagine raking your front yard in the fall. Your rake picks up most of the leaves, but also grabs pinecones, seeds, and any toys not already chopped up by the lawnmower. If you rake hard enough, you may even pull up some live grass, leaving a thin patch in the yard. The same happens in the ocean with large fishing trawlers. Fish are picked up in trawler nets, but so is the rest of the ecosystem. After years and years trawling, we begin to see dead-zones in the ocean…just like we see dead patches in our front lawn.

Fishing with trawlers yields high amounts of fish, but also leads to overfishing. If nothing stops the ocean trawling, the fish become near-extinct. For now, the Federal government has decided to limit the amount of trawlers fishing for salmon this season. But a one season limit is just a drop in a very big, empty bucket. If the Northwest truly wants to keep salmon from disappearing, fisherman are going to have to change their open water habits.

Images from: http://www.mongabay.com & http://www.greenpeace.org

I just caught an article from the Seattle Times titled “City of Seattle Won’t Buy Bottled Water“. The article states that Mayor Nickels approved the order because of the positive environmental impact, as well as the financial savings the city will experience. By cutting out bottled water expenses at various city events, Seattle could save close to $60k a year.

Besides costing more than tap water, bottled water has an array of negative environmental effects. Bottling water uses oil, energy, and natural resources. America’s water bottling industry burned 1.5 million barrels of oil last year. In addition, most empty bottles find their way into landfills.

“This is a matter of leading by example,” Nickels said. “The people of Seattle own one of the best water supplies in the country, every bit as good as bottled water and available at a fraction of the price. When you add up the tremendous environmental costs of disposable plastic bottles clogging our landfills, the better choice is crystal clear.”

I recently stumbled upon a website gathering pledges from people to stop using bottled water. I can’t find the blog that first posted the pledge (sorry unknown blogger), but if your a progressive individual who wants to fall in love with his or her tap water, sign up for the pledge! There’s also a quick collection of facts, some of which I poached for this posting. Check it out!

The public’s somewhat negative perception of bottled water is nothing new. Over the past year or so, it was revealed that several bottled water companies use tap water in their products. Many restaurants made headlines several months ago by taking bottled water off their menus in favor of tap water.

In my opinion, Mayor Nickels is doing one helluva job maintaining our lead as an environmentally progressive city. Better watch out San Francisco. You may be one step ahead of us for now, but give it time…

If you’re like me, it takes a good cup of coffee to get your morning started off right. And if you’re even more like me, you might think about the impact your coffee habit may have. By now, a lot of us coffee drinkers have heard about things like Fair Trade, organic, and shade grown coffee. Good news! Corporate and local coffee houses are offering these environmentally sound choices to us more frequently. Chances are, if coffee that’s environmentally friendly is offered, you’ll take it.

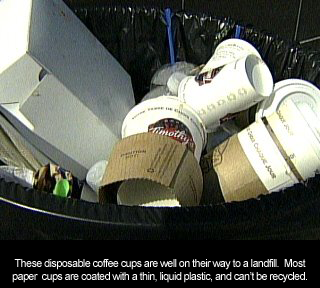

There’s another part of your coffee addiction that has a global impact. Your coffee cup. We see them everywhere but almost never give ’em a second thought. But those lattes and americanos that keep us working hard have a bitter environmental impact. In 2006, Americans added an estimated 16 billion coffee cups to our landfills! Think about it – how many cups have you thrown away this month? This week? The waste starts to add up fast, and in more places than just landfills. The entire process is incredibly resource intensive.

Here’s where it gets worse. Disposable paper cups are made almost exclusively from fresh wood from our forests. Once the lumber is transformed into paper, it’s coated with thin plastic and pressed into a cup. That plastic helps protect your hands from hot coffee – but it also condemns your cup to a landfill. Recycling can’t be done effectively on either end of a cup’s life cycle.

The real tragedy is that alternatives are easy and accessible. All of us have a reusable coffee mug stashed away in our kitchen, it’s just a matter of remembering to grab it on the way to work or school.

Now I’ll be honest. I’m one of those “latte-drinking, Prius-driving, Birkenstock-wearing” types of people. But using your own reusable coffee cup has more than just an environmental appeal. Those smart enough to remember a cup are often treated to a discount at coffee houses. Considering that most reusable coffee cups have life expectancies of 5 to 10 years, those discounts can add up. As an additional bonus, bringing your own cup helps out your favorite coffee house. Disposable cups are one of the largest costs to local shops, and most places would love to cut down on their expensive overhead.

Using your cup has more personal benefits as well. Reusable cups tend to keep your hot coffee hot and your cold drinks cold. If you’ve ever experienced a winter in Seattle, you know a mocha can go from hot to luke-warm in just a few minutes. Wouldn’t it be nice to enjoy your drink leisurely instead of chugging it down or throwing away the last few sips?

Using your cup has more personal benefits as well. Reusable cups tend to keep your hot coffee hot and your cold drinks cold. If you’ve ever experienced a winter in Seattle, you know a mocha can go from hot to luke-warm in just a few minutes. Wouldn’t it be nice to enjoy your drink leisurely instead of chugging it down or throwing away the last few sips?

The next time you’re getting ready to leave the house, think about drinking responsibly and bringing a reusable coffee cup. It’s quick and convenient, easy and painless. Not only will you be saving yourself money, you’ll be doing something good for the planet too.

For more in-depth information regarding sustainable coffee cups and disposable cups, please visit www.SustainabilityIsSexy.com

What’s Your Carbon Footprint?

March 6, 2008

I just stumbled upon a carbon footprint calculator, courtesy of the US EPA. I’ve seen a lot of these floating around the internet, but I particularly like this one. All the info needed is probably stored in your brain (as opposed to others, which ask for specific electricity measurements). If you haven’t done this before, take a second to find out where you stand. You might be surprised. (Calculator can be found here).

So where does the writer of Smart Sense stand? Luckily, my environmental side didn’t take too hard a hit. For my household of 2; 8,900 lbs of carbon a year are produced. That’s well under half of an average household.

Where do you stand?

Carbon Tax and Fuel Efficiency a Powerful Combo

March 4, 2008

Last week, I unwittingly got into a discussion with the folks from carbontax.org about BC’s new carbon tax. Most of the comments showed strong support for a carbon tax, but I was surprised that there was little support for encouraging fuel efficiencies. The collective mind seemed to think that a carbon tax was the only tool needed to curb carbon emissions. Now I doubt that specific mindset is a good representation of what most people believe, but it got me thinking. I agree a carbon tax is a great strategy, but is it the only one? Where does a carbon-tax fall short? Does encouraging fuel efficiency pick up the loose ends?

Pitfalls of a Carbon Tax

- A carbon tax’s goal is to lower the miles people drive. But what about those who can’t reduce? Commercial truck drivers are one group of carbon-emitters that won’t be changing their habits because of a carbon tax. For transport companies, driving less means less business. Transport services may become a bit more expensive, and truck drivers may not see a pay raise for a while, but carbon emissions won’t drop substantially.

- For any substantial change to happen, consumers need to notice consequences. However, most carbon taxes are modeled the same: taxes start off very small, and are slowly increased over time. By slowly, I mean about 10 cents a gallon slowly. Politicians are wary of pegging the tax too high, but adding an extra 10 cents a gallon tax is almost unnoticeable at today’s volatile gas pumps. For many, paying a bit extra at the pump is more convenient than changing their habits to be more environmentally friendly. It’ll take years before the tax is expensive enough to force a change in the average consumer. Even then, there will always be people rich enough and willing to pay to pollute. A carbon tax is a great long-term strategy, but doesn’t offer any short-term solutions.

A carbon tax is one sided, as there are two basic ways to change someone’s habits. One way is through negative consequences, the other through positive incentives. Training animals (stern voice vs tasty treat) is one basic example. When it comes to carbon emissions, a carbon tax is a negative consequence. But negative consequences aren’t always enough to cause change. Take a look at marijuana use. Marijuana has been illegal in the US for decades…but the drug’s use hasn’t slowed. A balance of negative consequences and positive incentives is the most effective means of changing habits.

A carbon tax is one sided, as there are two basic ways to change someone’s habits. One way is through negative consequences, the other through positive incentives. Training animals (stern voice vs tasty treat) is one basic example. When it comes to carbon emissions, a carbon tax is a negative consequence. But negative consequences aren’t always enough to cause change. Take a look at marijuana use. Marijuana has been illegal in the US for decades…but the drug’s use hasn’t slowed. A balance of negative consequences and positive incentives is the most effective means of changing habits.

The Benefits of Fuel Efficiency

If a carbon tax is peanut butter, fuel efficiency is the jelly. The two strategies combined provide a balanced plan toward decreasing carbon emissions from fossil fuels.

- Promoting fuel efficiency is the perfect short-term plan because it’s available now! The technology needed to reduce carbon outputs is already sitting on car lots. Burning carbon fuels more efficiently has the same effect as driving less. Right now, the big obstacle is getting fuel efficient vehicles into the hands of drivers. Once that problem is tackled, fuel efficiency could reduce carbon emissions in a very little amount of time.

Dollar for dollar, fuel efficiency has a bigger effect on consumers. BC’s carbon tax will cost a family about $50 a year. Driving a fuel efficient car could save that in a month or less. My personal situation: If I were to drive the hybrid version of my current auto, I’d save $50 in two weeks. That’s $2600 annually! When it comes to carbon, promoting fuel efficiency is more powerful simply because of the dollar amount attached. Additionally, fuel efficiency provides a positive incentive for emitters to change their habits. Wouldn’t you drive a hybrid if it meant saving hundreds every year?

Dollar for dollar, fuel efficiency has a bigger effect on consumers. BC’s carbon tax will cost a family about $50 a year. Driving a fuel efficient car could save that in a month or less. My personal situation: If I were to drive the hybrid version of my current auto, I’d save $50 in two weeks. That’s $2600 annually! When it comes to carbon, promoting fuel efficiency is more powerful simply because of the dollar amount attached. Additionally, fuel efficiency provides a positive incentive for emitters to change their habits. Wouldn’t you drive a hybrid if it meant saving hundreds every year?

- Fuel efficiency can reach people that a carbon tax can’t. Truck drivers and commuters who can’t bike or bus can still lower their carbon emissions with better fuel efficient cars. The same can be said for people who travel in distances more than what is covered by a carbon-tax. Fuel efficiency works no matter where the fuel is bought and burned.

The bottom line is that both a carbon-tax and fuel efficiency incentives are working toward the same goal. The planet doesn’t care how carbon emissions are lowered, so long as it’s done quickly. Why limit our options? The best strategy is one that uses everything in our toolbox; be it a carbon-tax or promoting fuel efficiency.

In 2005, the Congressional Budget Office estimated the cost of the Iraq war at $500bn. Stiglitz and the book’s co-author, Linda Bilmes, found this number to be surprisingly low. Discrepancies began to unveil themselves. For instance, the listed cost of the 2007 troop surge only accounted for combat troops. No funds were budgeted for the additional support troops needed as well. After years of data mining and number crunching, they’ve found the cost to be between 2 and 3 trillion dollars.

In 2005, the Congressional Budget Office estimated the cost of the Iraq war at $500bn. Stiglitz and the book’s co-author, Linda Bilmes, found this number to be surprisingly low. Discrepancies began to unveil themselves. For instance, the listed cost of the 2007 troop surge only accounted for combat troops. No funds were budgeted for the additional support troops needed as well. After years of data mining and number crunching, they’ve found the cost to be between 2 and 3 trillion dollars.